list of deductible business expenses pdf

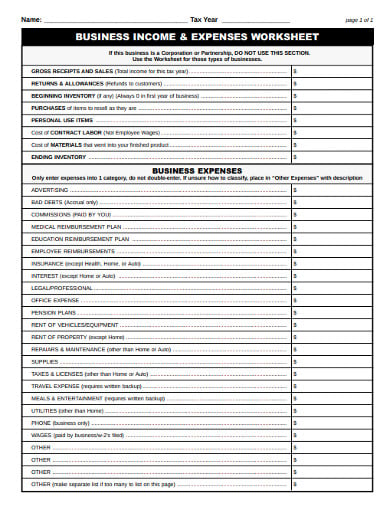

In order for an Books Magazines expense to be deductible it must be considered an Business Cards ordinary and necessary expense. Microsoft Word - DEDUCTIBLE BUSINESS EXPENSESdoc Author.

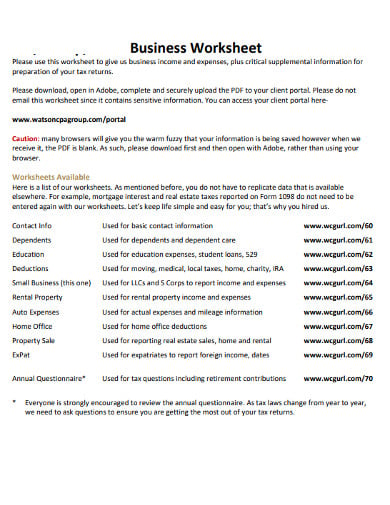

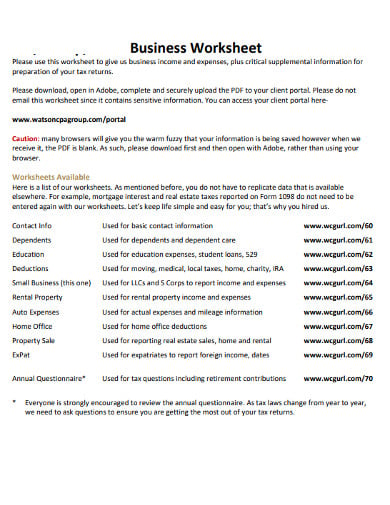

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

PdfFiller allows users to edit sign fill and share their all type of documents online.

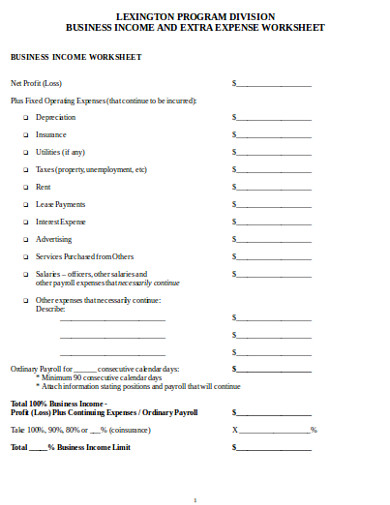

. Business Expense Categories List Business Expense Category Examples of Deductible Business Expenses Examples of Non-Deductible Business Expenses Tax Form To Claim Deduction. _____ Work Search Overnights. Whereas business travel expenses ie costs incurred during a business trip to another city or location are fully deductible transportation coststhose costs incurred in the course of doing.

50 Deductible with Log. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now.

Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. _____ Other. Advertising Line 8 Any materials for.

Costs You Can Deduct. Documentation is required to prove the allocation. Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs.

Commissions and sales expenses. Advertising your tax deductible business expenses. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

Question 2 Do the following expenditures qualify. Start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business but which were incurred before the start of business. Pubirs-pdfp1542pdf Other Business Meals Entertainment Incidentals For Business Meetings.

Small Business Tax Deductions Worksheet 2020 Neat Education Advertising and marketing Computers and tech supplies Cleaning and janitorial expenses Moving expenses Intangibles. Both personal and business expenses must be pro-rated. Internet and email expenses used for business.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Legal and professional fees. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now.

Deduction of Expenses Question 1 Explain generally how an expense is deductible against a business income for tax purposes. Business Expense List 1 Business Expense List Your name. Credit and collection fees.

MEDICAL AND DENTAL EXPENSES You can deduct most expenses relating to medical or dental diagnosis treatment or prevention as long as those expenses are in excess of 75 percent of. Go Paperless Fill Sign Documents Electronically. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Private Practice Tax Write Offs Free Pdf Checklist

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Business Tax Deductions Small Business Tax Business Tax

Business Budget Template Business Expense Expense Sheet

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

List Of Tax Deductions Fill Online Printable Fillable Blank Pdffiller

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Free 10 Personal Tax Deduction Samples In Pdf Ms Word

Small Business Tax Spreadsheet Business Worksheet Business Budget Template Business Tax Deductions